Need your

2023 Tax Return done?

At Auditax, we strive to minimise your taxes and maximise your tax returns. Our highly trained accountants can help you with:

- Lodging your Tax Return

- Finding all the applicable deductions

- Tax planning for the next Financial Year

- Negotiate payment plans for any tax liabilities incurred

Are you looking for a DIY Solution with advice?

OR

Are you looking for a Tax Agent to do your Return?

Consultation Only

$50 for 20 Minutes

Phone Call | Zoom | In Person

Are you doing your own Tax Return this year?

Do you just need some advice to clarify whether you can claim certain deductions? Maybe you are unsure about a certain part of the Tax Return?

This package is perfect for you!

There will be 0 obligation for you to do your Tax Return with us. Even if you change your mind later on and decide to do your Tax return with us, we will deduct this fees from your Tax Return fees.

Complete Tax Return

Starting at just $150

Phone Call | Zoom | In Person

Would you like us to take care of everything?

Do you just want to have a chat about your expenses and let our accountants take care of the rest? Think life is too busy to be doing all that paperwork?

This package is perfect for you!

Our tax accountants will have a 1-on-1 sitdown with you to take care of everything including going through your deductions, completing and lodging your Tax Return.

- "When are my taxes even due?!?"

- "What can I claim on my Tax Return?"

- “Can I deduct work from home expenses?”

- “When do I need receipts?"

These are just a few of the concerns that we’ve heard from people looking to find a new and more reliable tax agent. These are perfect examples of why it’s so vitally important to find a firm that will take the time to get to know your needs and provide services specific to your circumstances.

At Auditax, our primary goal is to offer you an exceptional experience and go the extra mile to ensure that your expectations are not only met but exceeded.

Handy Tax Return Calculator

Use our handy Tax Calculator to estimate your 2022-2023 Tax Return.

Please enter the amounts on the left. The calculator will update automatically.

Taxable Income |

$ |

Calculated Tax |

$ |

Tax Payable | $ |

Want to minimise your Tax? Choose Auditax.

Why Us?

Cut down your taxes

Hate paying extra? Us too! That's why our experts are always up to date with the latest tax return deductions for 2021.

Excellent Support

Our team will keep you updated throughout the process so you do not have to stay in the dark ever again.

Finish Taxes From 1990-2021

We can not only do this year's tax returns but also previous ones as well.

Specialised Experts

No chances of error or omission of any deductions or claims. We have a dedicated team of tax accountants with years of experience with tax returns.

Plan Ahead

At the time of lodging a tax return, all we can really do is help you identify everything that is eligible for a tax deduction. However, where we really excel is helping you plan ahead and determine what you can spend over the next year to minimise your tax liability!

Starting at Just $150

Ready to cut down your Taxes? Call our expert tax accountants or use our convenient online tool below to securely book an appointment.

Best part about our service?

If you are unhappy with the tax advice provided to you during your consultation session. Or if you no longer want to proceed with your Tax Return after talking to us. We will give you a full refund - no questions asked!

Some Commonly Asked Questions

I worked from home this year, can I claim that on Tax?

Yes, if you were employed and were working from home, you may be eligible for some tax deductions. These can include expenses such as electricity, decline in value of equipment/furniture and phone/internet expenses.

From 1 July 2022 there are 2 methods available to calculate your claim – a fixed rate or the traditional actual cost method. The ATO has revised the fixed rate for work from home expenses to 67 cents per hour. This allows you to claim a flat 67 cents per hour you worked from home. However, if you use this option, you will be ineligible to claim any additional expenses for working from home.

Is there any penalty for late lodgement of tax?

Yes, if you fail to pay your taxes on time, you may be liable for a ‘Failure To Lodge penalty’ from the ATO.

The penalty is charged @ 1 penalty unit for each period of 28 days or part thereof for which the return is overdue, up to a maximum of 5 penalty units. The value of one penalty unit is $210. This means that the minimum penalty that you can be charged if you delay your tax returns is $210 and the maximum penalty that can be levied is $1,050 i.e. 5 times the minimum penalty.

There are various factors that the ATO considers while charging a penalty for the overdue tax return. These include:

- Number of overdue tax returns;

- Your history of filing overdue tax returns; and

- The fact whether the taxpayer has not fulfilled the appeal to file their tax return or not.

Usually the penalty is applied automatically unless there was NIL tax payable or if there was a net refund from the Tax Return. We may be able to negotiate the penalty depending upon your circumstances.

I have to pay tax back! Can you help?

Well, first of all we will try to find all the possible deductions applicable to you to minimise your tax liability as much as possible (legally of course!). If you then get a refund…great! Otherwise we can negotiate a payment plan for you with the ATO.

What if I don't need to lodge a Tax Return?

Find out here if you need to lodge a tax return or not. If you usually lodge a tax return but don’t have to for one or more years – we recommend that you submit a non-lodgement advice (we can do this for our clients) because otherwise the ATO may assume you needed to lodge a tax return and commence compliance actions.

How does your money back guarantee work?

For consultation sessions that have been paid for up front, we will simply refund your amount if you are unhappy with our service.

If you haven’t paid for your Tax Return or Consultation session yet, we will simply stop if you ask us to and not charge you anything.

As simple as that!

What are the due dates for 2023 Tax Returns?

For every Financial Year ending on the 30th of June, the deadline to lodge a Tax Return is 31st of October unless an exemption applies to you. Therefore, your Tax Return can be lodged anytime between 1st of July 2023 and 31st of October 2023.

If you are residing in Australia and are liable to pay taxes then you must file your tax return on or before the deadline, unless your income is exempt or falls below the tax-free threshold limit.

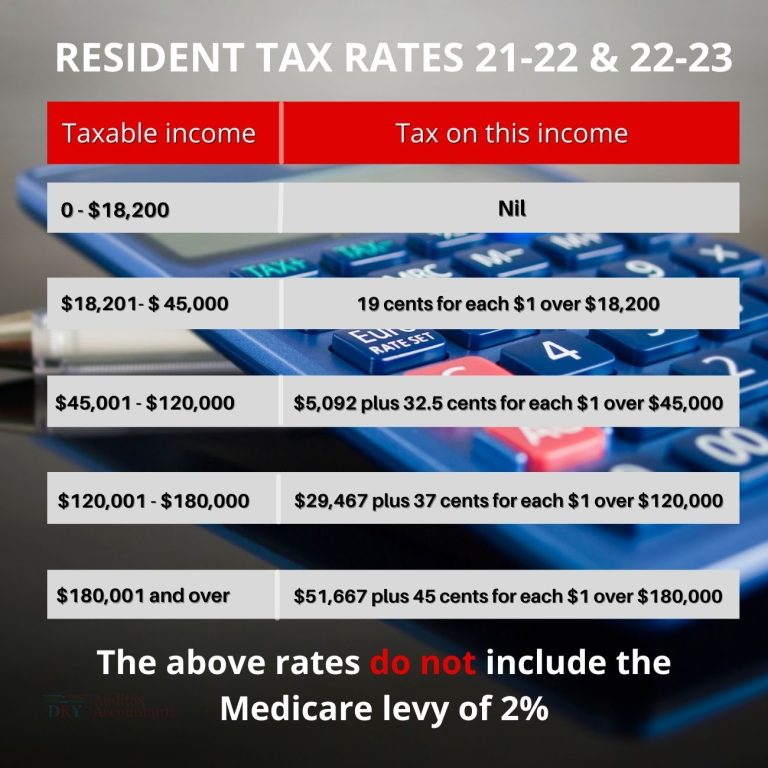

Tax Rates for 2023

Did we miss a question? Got any others?

You can use our convenient Chat Tool, which is down in the bottom right corner of your screen, call us directly at 1300 762 329, or simply use the form below to reach out to us. We’ll be happy to discuss your overdue taxes, how you’re currently managing your accounting, and how we can help. So reach out to us today to get started.

Our Blog

Mythbusters! Busting The Biggest Myths about Self-Managed Super Funds

Self-managed superannuation funds (SMSFs) are a great way to take complete control over your retirement. However, in recent years, SMSFs have come under a lot of scrutiny after the COVID-19 pandemic, leaving many Australians to question the legitimacy and safety of having a SMSF. Fear no more – Auditax Accountants have laid out 5 of the biggest myths surrounding SMSFs, so you can consider whether having one is right for you. Myth #1: You Need To Be A Millionaire To Open An SMSF While there are some general advice floating around about how much you should have to create and

Buying a House? Use Your Super to Save!

What? Use your Super to buy a house? Since when are you allowed to do that!? Since 2017! You may have heard of the First Home Super Saver (FHSS) Scheme, which was introduced in the 2017/18 Federal Budget, designed to help first-home buyers leverage their Super to save a house deposit. As of July 1st, 2022, individuals can withdraw a total of $50,000 from their Super if their previous contributions create the interest. For couples, this works out to be $100,000 that you can add to your home. Not half bad! Here are the basics! First home buyers can divert